Buyer Program

Join our buyer program email list to receive lower middle market opportunities

Unlock the Power of Passive Selling

You’ve come to the perfect location if you’re a private equity fund or a sizable, well-funded business looking for off-market, strategic deals. Joining our email list gives you the unique advantage of being the first to learn about off-market opportunities, such as SaaS businesses for sale, software companies for sale, and lower-middle market-sized service-based businesses for sale, that perfectly match your investment mandates.

You get a competitive advantage from these unadvertised off-market opportunities, which enable you to study and pursue new acquisitions without the same level of competition as advertised opportunities.

1. Vetted and Well-Prepared Businesses for Sale

We carefully screen and prepare each opportunity when it comes to the businesses we offer for sale, including SaaS businesses for sale and software companies. To ensure that the firms and owners of the lower middle market enterprises for sale, satisfy our exacting standards for quality, financial stability, and development potential, our team performs rigorous due diligence.

We thoroughly examine their financial standing, market positioning, clientele, growth potential, and other important parameters. By signing up for our list, you can be sure that the businesses you receive have been thoroughly vetted and presented in a professional and thorough manner.

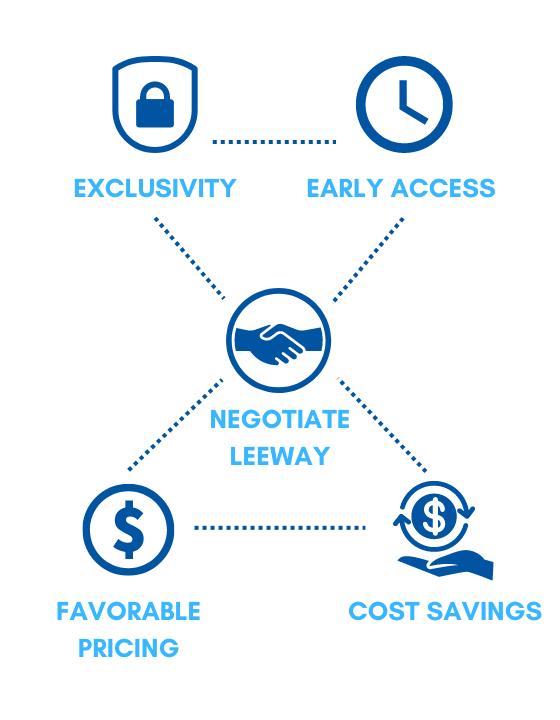

2. The Advantages of Off-Market Businesses for Sale

Off-market enterprises for sale provide buyers like you with a number of clear benefits. They first offer exclusivity. As a result of the limited competition and general market accessibility of these prospects, your chances of landing a deal with advantageous conditions are increased.

Before they are widely available to potential purchasers, you can assess and pursue these businesses, providing you an advantage in the market. Second, off-market companies frequently offer more negotiating leeway. Sellers might be more willing to take into account novel contract formats and satisfy particular buyer demands.

This flexibility might result in more favorable pricing and terms, letting you design a package that complements your investment philosophy. Finally, by bypassing a competitive auction procedure, off-market agreements may result in possible cost savings. By using our email distribution list to gain access to off-market opportunities, you may take advantage of these benefits.

3. Key Areas of Due Diligence

Due diligence is essential during the purchase process in assessing the financial, operational, and legal elements of the target software company. Our crew has expertise in preparing documentation for each of these important categories. Important areas for diligence include:

- Financial due diligence: You may evaluate and analyze historical financial statements, bank statements, and tax returns.

Operational due diligence: This includes evaluating the technology infrastructure, scalability, clientele, key performance indicators, growth potential, operational effectiveness, and risks of the target organization. - Legal Due Diligence: Review contracts, intellectual property rights, regulatory compliance, prospective legal liabilities, litigation trends, and other legal issues that could affect the acquisition as part of your legal due diligence.

- Commercial due diligence: involves assessing the market positioning, competitive environment, clientele, sales, and marketing plans, product line, and expansion prospects of the target company.

- Human Resources Due Diligence: Assessing the workforce, talent retention, organizational structure, employment contracts, and potential HR-related risks or issues for the target company.

- Environmental and Sustainability Due Diligence: Examining the target company’s environmental effect, compliance with environmental laws, sustainability initiatives, and related risks or liabilities is known as due diligence.

- Cultural Due Diligence: Understanding the corporate culture, values, and compatibility of the target company with the culture of the acquiring corporation through cultural due diligence

4. Value Creation and Post-Acquisition Integration

Aware as we are of the significance of post-acquisition integration and value development, we work with you to align technology systems, streamline workflows, and promote cultural cohesion as part of your post-acquisition integration plan.

Our goal is to make the transition go smoothly and to make it easier to take advantage of synergies and growth prospects. You can successfully handle the post-acquisition process and create value for your firm by utilizing our resources and expertise.

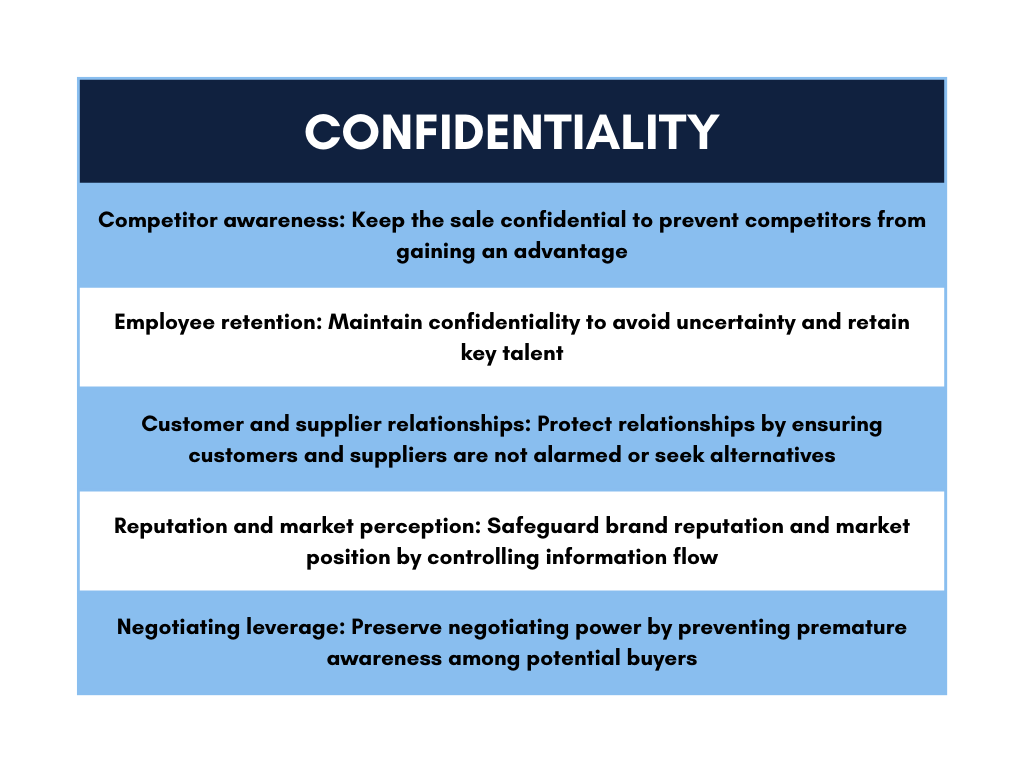

5. Confidentiality and Privacy

We recognize the importance of confidentiality and privacy in the acquisition process. Our email distribution list operates with the utmost discretion and safeguards the privacy of our subscribers.You may be sure that your participation and information will be treated in a strictly secret manner. To safeguard your personal information and provide a secure environment for communication and deal evaluation, we follow industry best practices. Your privacy and trust are extremely important to us.

Sign up for our email distribution list today to gain access to off-market deals and be among the first to receive information about potential acquisitions. Benefit from our tailored approach, confidentiality, expert assistance, post-acquisition integration support, and value-creation guidance to secure the perfect software company for your portfolio. Join our buyer program list now and position yourself for success in the dynamic software industry.