Sell Your SaaS Company Through a Structured Process - Not Luck.

For founder-led SaaS companies with $2-10M ARR. Quiet, competitive processes that attract serious buyers, protect leverage, and maximize cash at close.

Who I Work With – and When It Makes Sense to Talk

This is a fit if:

- You run a SaaS business with $2–10 million in annual recurring revenue

- You are founder-led or lightly institutional

- You are seriously considering a sale in the next 12–24 months

- You want to understand buyer interest and timing before committing

- You care about buyer quality, deal certainty, and cash at close

- You want a quiet, controlled process that doesn’t disrupt operations

This is not a fit if:

- Your company is pre-revenue or early-stage

- You are selling “IP,” a brand, or future potential

- You are looking for an exploratory valuation or curiosity call

- You are not yet thinking seriously about a sale timeline

- You want to “see what’s possible” rather than make real decisions

- You are pre-ARR or believe future growth alone justifies a sale today.

Founder Reality

Most founders I speak with aren’t sure they want to sell yet. They’re balancing growth, fatigue, market timing, and responsibility to their team.

A good process starts with clarity – not pressure.

What Founders Often Get Wrong About Selling

- Talking to a few buyers instead of creating competition

- Confusing early interest with real offers

- Optimizing for the valuation headline instead of the deal terms

- Letting the process momentum fade during diligence

A structured process fixes these issues before they quietly erode deal value. Here is a more detailed guide: “How do I sell my SaaS company?”

How My Process is Different

- I run a multi-buyer process

- All buyers are pre-screened

- I manage leverage intentionally

- Terms matter as much as price

Why Founders Hire Me

I typically work with a small number of founders at one time.

I run a process designed to create leverage – not dependence on a single buyer.

- Multiple qualified buyers engaged simultaneously

- Clear timelines, deadlines, and accountability

- Offers compared on structure, certainty, and cash at close – not just headline valuation

This is not a listing service. It’s a managed sale process.

Founders hire me when they want:

- Serious buyers instead of endless meetings

- Clean communication without noise

- Momentum through diligence and closing

Software Native Execution

I focus on software and tech-enabled service businesses. Deals are evaluated using the metrics institutional buyers actually care about:

ARR quality, retention dynamics, revenue concentration, growth efficiency, customer durability and operational risk.

This allows realistic positioning and stronger negotiations – because we speak the same language as the buyers.

Process Discipline

- Buyer qualification before access to sensitive information

- Competitive process design to maintain leverage

- LOIs with defined expectations and timelines

- Active management of diligence to avoid slow-roll behavior

If a buyer stops performing, alternatives are already engaged.

Proven Track Record

Proven Results – I focus on fewer engagements and run each one with full attention. The result is consistent buyer competition and strong deal certainty across processes.

How the Sale Process Works

- Position the business for institutional buyers

- Build a targeted buyer universe (strategic + PE + qualified operators)

- Control information flow and buyer communication

- Create competitive tension during LOI stage

- Manage diligence to maintain speed and leverage

- Drive toward clean closing terms with maximum cash at close

You stay focused on running the company while the process runs quietly in the background. You stay in control of decisions. I control the process.

How This Fits With Your Existing Advisors

Most founders already work with an accountant and, in some cases, a general business attorney. I routinely work with existing advisors when they have relevant transaction experience.

Selling a software company introduces a different set of decisions around process, leverage, timing, and deal structure – many of which occur before tax and legal documents are finalized.

My role is to design and manage the sale process and coordinate the right expertise at each stage. That may include your current accountant and attorney, or M&A-experienced professionals who specialize in these transactions.

The choice is always yours. My responsibility is to ensure the deal is executed by people who understand how software company sales actually work, so early decisions don’t limit outcomes later.

What Happens After You Reach Out

Step 1 – Initial Conversation (20-30 minutes)

We discuss:

- Where your company sits today in the market

- Buyer types that are most likely to engage

- Timing considerations and preparation gaps

- Whether a sale process makes sense now or later

No valuation pitch. No pressure to move forward.

Step 2 – Fit Assessment

If there’s a strong fit, I’ll outline:

- Likely buyer categories

- Expected process design

- Timing and preparation priorities

If it’s not the right timing, I’ll tell you directly.

Step 3 – Decision Point

You decide whether to:

- Move forward with a structured process, or

- Wait until the timing is stronger

Representative Examples of Recent Transactions

Core focus is software and tech-enabled services. I selectively represent other founder-led businesses with strong earnings and transferable operations.

Additional founder-led transactions were completed across SaaS, tech-enabled services, and professional service businesses.

Industry Recognition and Affiliations

As a member of the International Business Brokers Association (IBBA) and the California Association of Business Brokers (CABB), committed to the industry’s highest ethics and professionalism.

Meet David

Software Industry Experience

Before becoming an advisor, I built and sold my own company and worked inside large software organizations including Oracle, Siebel, and SUSE Linux.

I’ve seen acquisitions from both sides of the table – strategic buyers, financial buyers, and founder exits. That perspective shapes how I structure processes today.

My Business Exit

I’ve sold my own company, so I understand what founders worry about during a sale — unqualified buyers, confidentiality risks, and processes that drag on without real progress.

That experience shapes how I run every engagement. I run a structured, competitive process designed to attract serious buyers, maintain leverage, and keep momentum toward a clear outcome.

My goal is simple: a clean close on market-standard terms, with strong cash at close and as little complexity as possible.

Ideal Sell-Side Client Profile

For sell-side engagements, I look for clients with the following:

Software and SaaS companies: $2-$10 million in ARR.

Other businesses: $300k-$3 million in EBITDA.

Thinking about Selling?

If you’re considering how to sell your SaaS company, or you’ve already received a letter of intent from a buyer, it’s important to understand your leverage before making a decision.

Earnouts Explained: When They Make Sense and How to Structure Them

Earnouts are often introduced in transactions to bridge valuation gaps. When buyers and sellers see future performance differently, an earnout

From Spreadsheet to Wire Transfer: Why SaaS Transaction Prices Differ from Financial Valuations

In the $3–20M SaaS market, valuation tension rarely comes from bad math. More often, it comes from a shift in

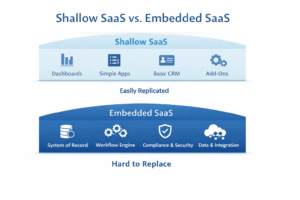

The Death of Shallow SaaS: How AI Is Repricing Software Valuations

The Death of Shallow SaaS Over the past few months, public software stocks have sold off sharply. Some commentators have