How I Work With Referred Clients

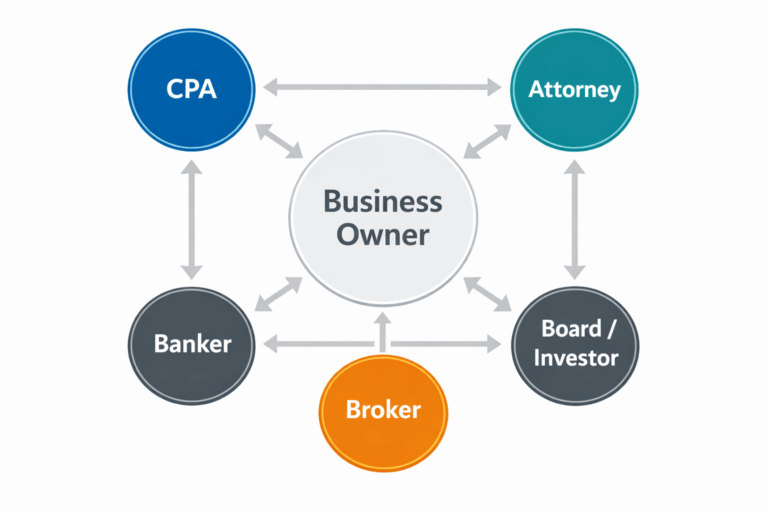

Many of my sell-side clients are introduced by their CPA, attorney, board member, banker, or investor. This page explains how I work with referred clients when advising owners through the sale of a software or tech-enabled service company. Regardless of who makes the introduction, my role is always the same: to represent the seller exclusively, run a disciplined process, and protect outcomes.

This page explains how coordination works when a trusted advisor introduces a client who is considering the sale of a software or tech-enabled service company.

Working With Referred Clients Introduced by Trusted Advisors

Owners often speak with a CPA, attorney, banker, investor, or board member before they speak with a broker. That is usually a good sign — it means the decision is being approached thoughtfully.

When a client is referred to me, there is no alternate process and no special treatment based on who made the introduction. My responsibility is always to the seller, and my approach remains consistent regardless of the referral source.

This page is intended to clarify roles, expectations, and coordination so that everyone involved can work effectively and avoid unnecessary friction later in the process.

Clear Roles, Clear Responsibilities

Successful transactions depend on clear boundaries.

My role

I work with owners of software and tech-enabled service companies to:

- Assess readiness to sell and timing considerations

- Establish realistic valuation expectations

- Design and run a competitive, controlled sale process

- Qualify buyers and evaluate offers

- Manage transaction-level risk related to structure, timing, and buyer quality

What I do not do

- I do not provide tax advice

- I do not provide legal advice

- I do not replace existing advisors

Role of CPAs, attorneys, and other advisors

- CPAs advise on tax structuring, modeling, and after-tax outcomes

- Attorneys handle legal documentation, representations, warranties, and risk protection

- Bankers, investors, and board members provide capital, fiduciary oversight, and governance input

Clear role definition early prevents confusion and misalignment later.

How Coordination Works in Practice

Coordination works best when it starts early.

In practice, this means:

- Early alignment on goals and constraints

Understanding what matters most to the seller — liquidity, risk tolerance, timing, legacy considerations — before buyers enter the picture. - Shared understanding of process and timing

Ensuring advisors understand how the sale process will unfold and when key decisions will be required. - Clean information flow

Financial, operational, and technical information is shared deliberately and securely, without unnecessary duplication or last-minute scrambling. - Avoiding surprises at LOI and diligence

Many problems arise not from bad intentions, but from assumptions made too late. Early coordination reduces transaction risk and prevents surprises later in the selling process. - Respect for professional independence

Each advisor retains independent judgment. Disagreement is handled directly and professionally, with the seller’s interests as the guiding principle.

Reducing Transaction Risk for Everyone Involved

A large part of my role is handling the risks that tend to create downstream problems for sellers and their advisors.

These include:

- Buyer qualification

Confirming seriousness, experience, and proof of capital before momentum builds around an offer. - Headline price vs. cash-at-close reality

Helping sellers understand how structure, earnouts, rollover equity, and working-capital mechanics affect actual proceeds. - Earnout and rollover risk

Identifying where incentives may diverge after closing and how those risks are commonly underestimated. - Working capital adjustments

Clarifying expectations early so closing mechanics do not become adversarial. - Timeline discipline

Preventing deals from drifting indefinitely, which increases fatigue, risk, and regret.

By managing these issues at the transaction level, I allow CPAs, attorneys, and other advisors to focus on their areas of expertise without being pulled into avoidable conflicts.

Independence and Incentive Alignment

I represent the seller only.

- I do not pay referral fees

- I do not structure transactions to benefit one advisor over another

- I do not change my approach based on who made the introduction

My incentives are aligned solely with the seller’s outcome. This clarity tends to attract referrals from professionals who value independence, transparency, and long-term client trust.

What Referred Clients Can Expect

Clients who come to me through a referral typically experience:

- A calm, structured process

- Direct and realistic communication

- No pressure to transact

- No surprises late in the process

- Respect for existing advisory relationships

Not every introduction results in a transaction. In many cases, the most valuable outcome is clarity — understanding timing, readiness, or why waiting may be the right decision.

Coordinating Early Leads to Better Outcomes

When working with referred clients, early coordination helps align expectations, reduce friction, and protect outcomes for everyone involved.

I work exclusively with software and tech-enabled service companies and limit the number of clients I take on at any given time.