The Death of Shallow SaaS: How AI Is Repricing Software Valuations

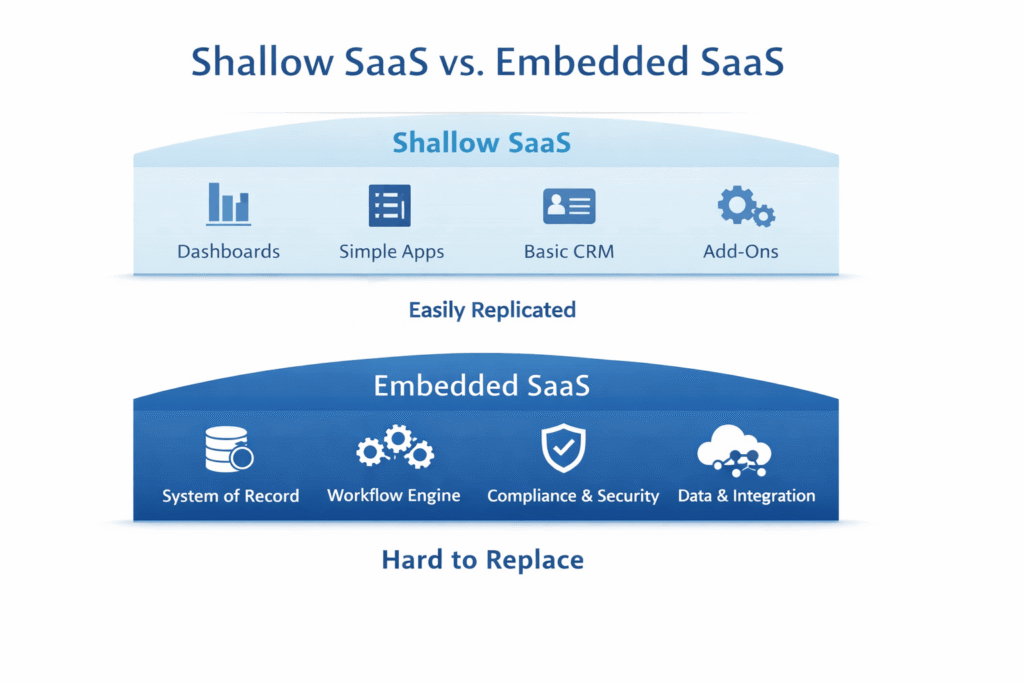

The Death of Shallow SaaS Over the past few months, public software stocks have sold off sharply. Some commentators have labeled it a “SaaS-pocalypse.” That framing is dramatic. It’s also misleading. SaaS is not dying. But a certain type of SaaS is under real pressure. What we’re seeing is not the end of software. It’s […]

The Death of Shallow SaaS: How AI Is Repricing Software Valuations Read More »