Cash at Close vs Earnouts in SaaS Acquisitions

When founders sell a SaaS business, the headline price rarely tells the full story. What ultimately matters is cash at close vs earnouts — how much money the seller receives at closing versus how much depends on future performance.

Understanding this distinction early shapes expectations, negotiation strategy, and final outcomes.

This guide explains how cash at close and earnouts actually work in SaaS acquisitions, why buyers push for earnouts, and how founders should evaluate risk before agreeing to them.

What Is Cash at Close in a SaaS Acquisition?

Cash at close refers to the portion of the purchase price paid to the seller at closing, without future conditions attached. Once the deal closes, this money belongs to the founder regardless of what happens next.

In SaaS transactions, cash at close typically includes:

- Buyer equity or debt funding paid on closing day

- Any portion of consideration not tied to post-close performance

- Net proceeds after escrow or holdbacks (if applicable)

Founders value cash at close because it:

- Eliminates future execution risk

- Avoids disputes over performance metrics

- Provides immediate financial certainty

In practice, cash-heavy offers close more reliably than earnout-heavy structures.

What Is an Earnout in a SaaS Deal?

An earnout defers a portion of the purchase price and conditions payment on future results. Buyers usually tie earnouts to:

- Revenue or ARR targets

- EBITDA or adjusted EBITDA thresholds

- Customer retention or churn metrics

- Product milestones or integrations

Earnouts shift risk from the buyer to the seller. After closing, the founder must still deliver specific results — often under new ownership and constraints.

While earnouts sometimes increase headline price, they frequently reduce realized value for the seller.

Why Buyers Push for Earnouts

Buyers don’t propose earnouts randomly. They use them to manage perceived risk.

Common buyer motivations include:

- Uncertainty around growth sustainability

- Founder dependency in sales or relationships

- Customer concentration or churn concerns

- Product roadmap or technical risk

- Integration uncertainty post-acquisition

Instead of discounting price outright, buyers often preserve valuation optics by shifting risk into an earnout.

From the buyer’s perspective, earnouts feel safer. From the seller’s perspective, they introduce complexity and uncertainty.

Cash at Close vs Earnouts: Key Differences

| Dimension | Cash at Close | Earnout |

|---|---|---|

| Payment timing | Immediate | Deferred |

| Performance risk | Buyer | Seller |

| Dispute potential | Low | High |

| Founder dependency post-close | Lower | Higher |

| Certainty of proceeds | High | Conditional |

In founder-led SaaS deals, these differences materially affect both outcome and experience.

What Earnouts Look Like in Real SaaS Transactions

In practice, most SaaS earnouts fail to pay in full.

Common reasons include:

- Metric definitions change after closing

- Strategic priorities shift under new ownership

- Integration reduces seller control

- Disputes arise over attribution or adjustments

Even well-intentioned buyers rarely optimize operations for a seller’s earnout.

As a result, founders should treat earnouts as probabilistic upside, not guaranteed consideration.

How Earnout Metrics Change Under New Ownership

Many founders assume earnout metrics will behave the same way after closing as they did before the sale. In practice, ownership changes often alter the underlying math — sometimes unintentionally, sometimes structurally.

Even when buyers act in good faith, post-close decisions frequently reshape how earnout performance is measured.

Expense Allocation and Management Fees

After closing, buyers often introduce new overhead that did not exist before the transaction. These expenses can materially affect earnout performance.

Common changes include:

- Management or monitoring fees charged by the parent entity

- Centralized shared services for finance, HR, or legal

- New executive or integration roles allocated across portfolio companies

- Additional compliance or reporting costs

Even when earnouts rely on revenue metrics, buyers often adjust performance calculations using “normalized” or “adjusted” figures. As a result, sellers may see profitability-based earnouts shrink despite stable top-line growth.

Changes in Hiring Strategy and Cost Structure

Buyers frequently pursue growth or integration initiatives immediately after closing. These decisions often require new hires.

Examples include:

- Additional sales leadership

- Expanded customer success teams

- Centralized engineering or product roles

- Integration or platform personnel

While these hires may support long-term strategy, they also increase operating expenses during the earnout period. If earnout metrics depend on EBITDA or contribution margin, the seller may lose payout eligibility despite revenue performance.

Revenue Recognition and Accounting Changes

New owners often impose different accounting standards, especially when rolling the acquired company into a larger organization.

Typical changes include:

- Shifting from cash to accrual revenue recognition

- Reclassifying professional services or onboarding revenue

- Deferring revenue previously recognized upfront

- Adjusting ARR definitions to align with portfolio standards

These changes can alter reported performance without changing underlying customer behavior. Founders who rely on historical metrics often discover that earnout targets move once accounting definitions change.

Churn Definitions and Retention Strategy Shifts

Churn calculations rarely stay static after an acquisition.

Buyers may:

- Redefine gross vs net churn

- Exclude expansions from retention calculations

- Reclassify downgrades differently

- Introduce pricing or packaging changes that affect churn metrics

At the same time, buyers may shift go-to-market strategy, such as changing:

- Customer acquisition channels

- Pricing tiers or discounting practices

- Contract length or renewal policies

These changes can increase churn temporarily, even if the product remains strong. When earnouts depend on retention metrics, sellers may miss targets despite healthy underlying demand.

Loss of Control During the Earnout Period

After closing, founders rarely retain full decision-making authority. However, earnout performance often assumes continuity.

In practice:

- Sellers lose control over pricing and discounting

- Marketing spend decisions move upstream

- Product roadmaps shift to fit portfolio strategy

- Customer segmentation and focus change

This disconnect creates risk. Founders remain responsible for outcomes they no longer fully control.

Why Earnout Disputes Are Common

These structural changes explain why earnouts frequently lead to disputes.

Founders expected:

- Continuity

- Stable metrics

- Control over outcomes

Instead, they encounter:

- New definitions

- New expense layers

- New priorities

Even when buyers do not intend to disadvantage sellers, earnouts often fail to pay in full because incentives no longer align.

Practical Takeaway for Founders

Founders should assume earnout metrics will evolve after closing — often in ways that reduce payout probability.

Before agreeing to an earnout, sellers should:

- Demand precise metric definitions

- Limit buyer discretion where possible

- Shorten earnout periods

- Prioritize cash at close over contingent upside

In most SaaS transactions, reducing earnout reliance improves both certainty and realized value.

These risks explain why founders who prioritize cash certainty often choose processes that reduce earnout dependency altogether.

When Earnouts Make Sense (and When They Don’t)

Earnouts can work when:

- Metrics are simple, objective, and auditable

- The founder retains real operational control

- The earnout period is short (12 months or less)

- The buyer aligns incentives explicitly

Earnouts often fail when:

- Metrics rely on discretionary “adjustments”

- The buyer controls pricing, staffing, or marketing

- Strategic integrations affect performance

- Earnout periods exceed 18–24 months

In most founder-owned SaaS companies, earnouts increase risk without increasing expected value.

How Deal Size Affects Cash at Close vs Earnouts

Deal size strongly influences structure:

Under $2M EV:

Marketplaces frequently rely on earnouts due to buyer quality and funding constraints.$5M–$30M EV:

Broker-led processes typically emphasize higher cash at close and limit earnouts.$30M+ EV:

Institutional buyers use earnouts selectively, often tied to strategic integrations.

For founders in the $5M–$30M range, choosing the right process directly impacts cash certainty. This is why process selection matters as much as valuation.

(Internal link: Broker vs Marketplace vs Investment Bank for SaaS Companies)

How Brokers Reduce Earnout Dependency

Experienced SaaS brokers reduce earnouts by:

- Pre-qualifying capitalized buyers

- Creating competitive tension among bidders

- Stress-testing buyer concerns before LOIs

- Anchoring negotiations around cash certainty

When multiple qualified buyers compete, earnouts naturally shrink.

This dynamic explains why broker-led SaaS transactions typically produce higher realized value, even when headline prices appear similar.

How Founders Should Evaluate an Offer

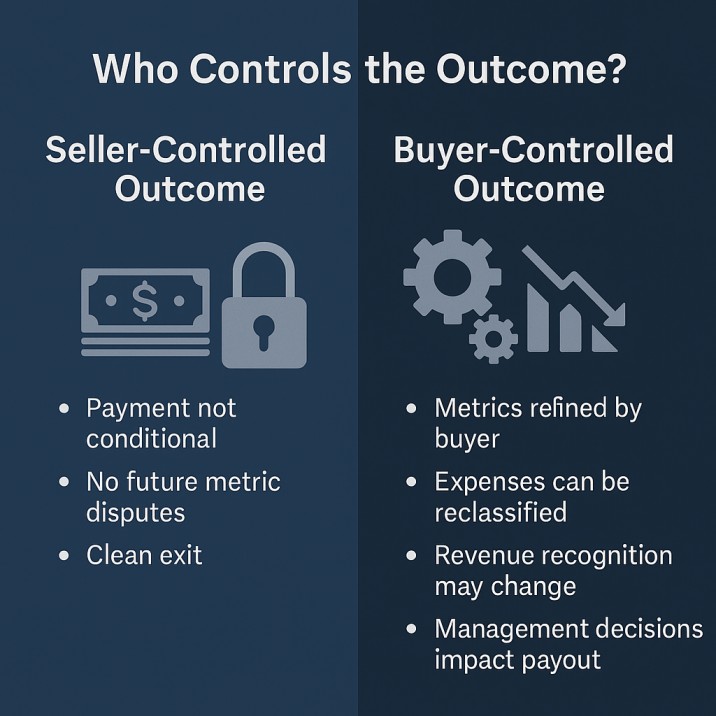

Before accepting an earnout-heavy offer, founders should ask:

- How much cash do I receive at close?

- Who controls the earnout metrics after closing?

- What breaks my ability to earn it?

- How often do similar earnouts fully pay out?

Clear answers matter more than headline valuation.

If deal terms feel complex or one-sided, they often signal misaligned incentives — not clever structuring.

Final Thoughts

In SaaS M&A, cash at close vs earnouts determines real outcomes, not press releases.

Founders maximize success when they:

- Prioritize certainty over optics

- Treat earnouts as risk, not upside

- Choose processes that attract qualified buyers

- Negotiate from competitive leverage

The right structure doesn’t just improve price — it increases the likelihood the deal actually closes.