SaaS & Software M&A Advisor

Helping Founders of $2M–$20M+ ARR Software Companies Achieve Premium Exits

Founders We Help

Selling a software company is fundamentally different from selling a traditional business. Buyers evaluate recurring revenue, churn, product adoption, codebase maturity, and customer acquisition efficiency—not just profit. I specialize in representing profitable, growing SaaS and software companies and running a confidential, competitive process that drives multiple, above-market offers.

No retainer. No drama.

A structured, confidential process that gets multiple offers and deals closed.

Who I Work With

I represent founders of:

- Vertical SaaS platforms

- B2B subscription software companies

- API-driven businesses

- Cloud and mobile applications

- Data, analytics & workflow automation platforms

- FinTech, InsurTech, PropTech, and GovTech software

- Software-enabled services with recurring revenue

- Mission-critical niche tools with loyal customer adoption

Typical client profile:

- $2M–$20M+ ARR

- 10–30%+ EBITDA (or profitable with a clear path to expansion)

- Churn under 10%

- Strong net revenue retention

- Founder/operator looking to de-risk, transition, or partner with a strategic or PE firm

Why Software Companies Are in High Demand

Strategic acquirers and private equity buyers continue to pursue software businesses because:

Recurring revenue is the strongest financial model

Predictable ARR/MRR and cohort stability command premium valuations.

High gross margins create scalable growth

Once product is built, incremental users are extremely profitable.

Buyers want entry into vertical markets

Niche SaaS markets—especially ones with deep workflow penetration—are highly defensible.

Technology costs less than time

Strategics often acquire to accelerate their roadmap instead of building internally.

Fragmented markets = consolidation opportunity

Buyers see roll-up potential in fragmented SaaS verticals.

If your software provides critical daily functionality, has low churn, and serves a defensible niche, demand will be strong.

What Drives SaaS Valuation

Unlike traditional businesses, SaaS valuations reflect a mix of financial and product-level metrics.

1. Growth Rate

Buyers evaluate ARR trajectory, expansion revenue, customer adoption, and sales efficiency.

2. Net Revenue Retention (NRR)

NRR over 100% is highly valuable; above 110% is elite.

3. Gross Margins

Most healthy SaaS companies operate at 70–90%+ gross margin.

4. Churn & Customer Concentration

Lower churn = higher valuation; lower concentration reduces perceived risk.

5. Quality of Codebase & Scalability

Buyers look for modern architecture, strong documentation, and low technical debt.

6. Customer Acquisition Metrics

CAC payback, LTV/CAC ratio, blended CAC, and go-to-market efficiency.

Typical SaaS Valuation Multiples (2024–2026)

Valuations vary widely depending on growth, margins, churn, and market positioning:

| SaaS Profile | Typical Valuation |

|---|---|

| Slow-growth, stable SaaS (0–10% growth) | 2–4× ARR or 6–9× EBITDA |

| Steady-growth SaaS (10–25%) | 3–6× ARR or 8–12× EBITDA |

| High-growth SaaS (25–50% growth) | 5–8× ARR or 12–18× EBITDA |

| Vertical SaaS with low churn | 5–9× ARR |

| API-first or infrastructure SaaS | 6–10× ARR |

| Elite SaaS (40%+ growth, strong NRR) | 8–12× ARR+ in competitive processes |

Note: Real outcomes depend heavily on the quality of revenue, retention, margins, vertical specialization, and buyer competition.

My Process Produces Multiple Offers

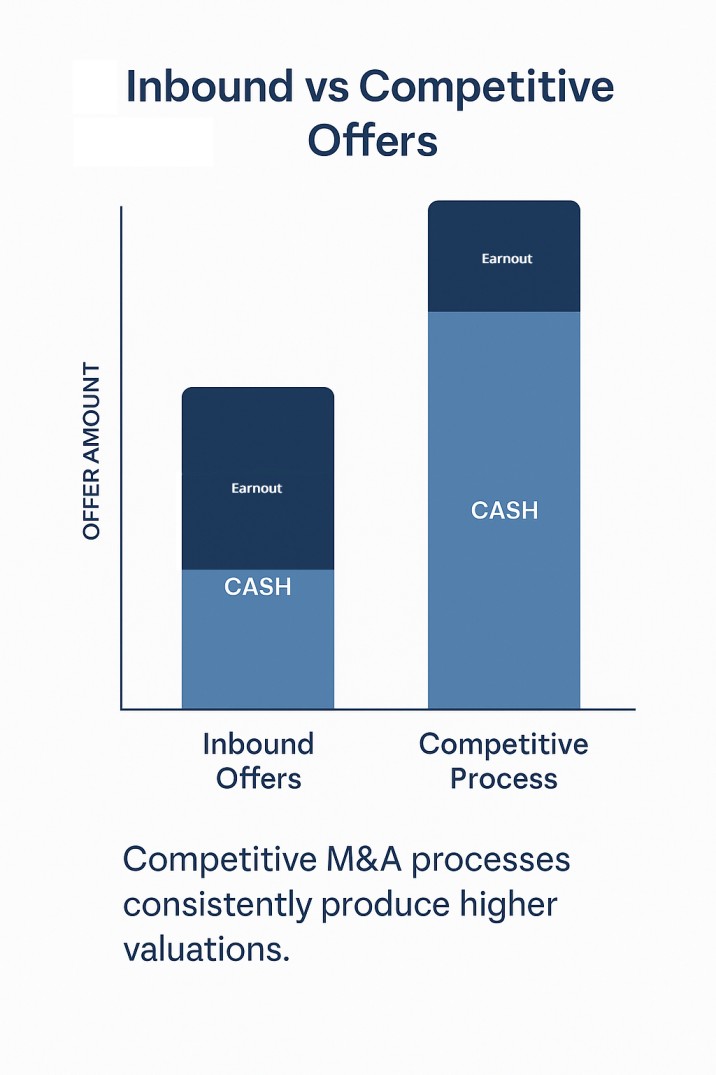

Many founders engage with one or two inbound buyers and assume those offers reflect market value. They almost never do.

A competitive process changes everything.

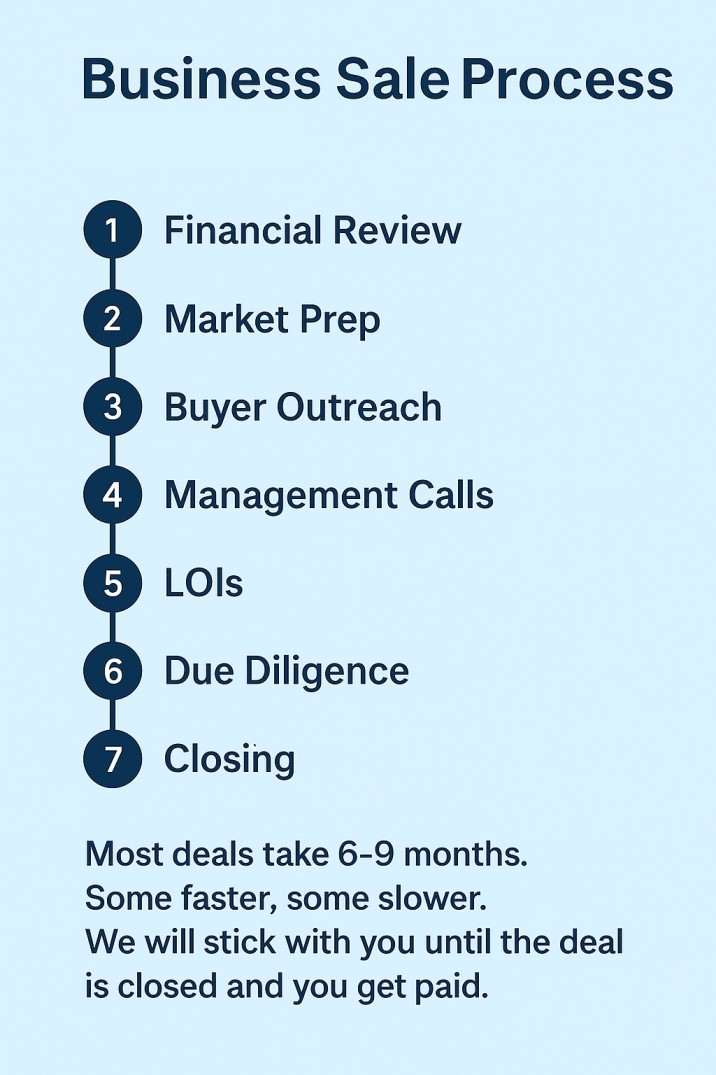

My Sell-Side Process

- Introductory call

- Confidentiality agreement

- Deep dive into financials and SaaS metrics

- Normalized financial analysis & valuation guidance

- Marketing materials (CBR) built specifically for software companies

- Outreach to 300–1,000+ qualified SaaS buyers

- NDA qualification & controlled release of sensitive data

- Structured buyer–founder meetings

- Multiple written offers

- Selection, negotiation & signing of the LOI

- Diligence management

- Closing

A controlled, competitive environment produces superior valuations and cleaner terms.

What Software Founders Care About (and I Prioritize)

Confidentiality

Your employees, customers, and competitors will not know the company is for sale. Only vetted buyers, under NDA, receive access.

Clean Deal Terms

I prioritize:

- Maximum cash at close

- Minimal earnouts

- Reasonable reps & warranties

- Limited seller financing

- Predictable working-capital adjustments

Technical & Financial Understanding

I understand:

- ARR vs Non-recurring revenue

- Deferred and GAAP revenue

- Capitalized software costs

- Net retention and churn math

- Cohort analysis

- Product–market fit dynamics

Software diligence can be complex—my process reduces surprises.

Why Work with Me

Deep SaaS Expertise

I’ve built, run, and sold software companies. I speak the language—LTV/CAC, churn cohorts, product metrics, architecture, and cash flow.

100% Success Rate With Profitable Companies

Every profitable company I’ve represented has successfully closed.

Specialized Buyer Network

Hundreds of private equity firms, strategic acquirers, and family offices actively looking for SaaS deals.

Direct, Honest, No-Drama Approach

No pressure. No games. Just a structured process that works.

Is now the Right Time to Sell?

You may be considering a sale if:

- You want to de-risk and convert equity into liquidity

- Growth has slowed and you want a partner to scale

- Burnout or fatigue from years of development and customer support

- Competitive pressure or rising acquisition costs

- Desire to focus on new ventures

- Strong offers coming inbound, but unclear if they reflect true market value

If any of these resonate, it may be worth a confidential conversation.

Next Step: Confidential Intro Call

If you own a SaaS or software company with at least $2m in annually recurring revenue and are considering selling in the next 12–24 months, let’s talk.

Schedule a confidential call

I’ll give you:

- An honest valuation range

- Clear next steps

- Realistic expectations

- Zero pressure

You only sell your business once.

The right partner and the right process make all the difference.