MSP & IT Services M&A Advisor

Helping MSP, Cybersecurity, Cloud & IT Services Owners Sell for Premium Valuations

How We Can Help

Most MSP and IT services owners don’t realize how much strategic and private equity demand exists for high-performing firms. I specialize in representing profitable, well-run technology services companies and creating a competitive buyer environment that produces multiple, above-market offers—typically 10 to 30 written offers for qualifying companies.

No retainer. No drama.

A structured, confidential process that gets multiple offers and deals closed.

Who I Work With

I represent owners of profitable, growing companies in:

- Managed Service Providers (MSPs)

- Cybersecurity services and compliance (SOC 2, HIPAA, NIST, vCISO)

- Cloud migration & DevOps consulting

- IT consulting and professional services

- Systems integrators

- Helpdesk, NOC/SOC outsourcing

- Data, analytics & automation consulting

- Vertical-focused IT service providers (healthcare, legal, finance, industrial, etc.)

Typical client profile:

- $5M–$25M+ valuation range

- 10–100 employees

- 10–25%+ EBITDA

- Recurring revenue and long-term client relationships

- Owner is ready to reduce day-to-day responsibilities, retire, or transition into a more strategic role

Why MSPs and IT Service Firms are in High Demand

Private equity funds, family offices, and corporate buyers are aggressively acquiring IT services companies because:

Recurring revenue = predictable returns

High-margin managed services create stable, contract-based cash flows.

Cybersecurity is exploding

Buyers want security capabilities baked into the service stack.

Cross-sell potential is huge

Strategics can expand regional coverage, cloud capabilities, or vertical specialization.

Aging founders and fragmentation

Tens of thousands of MSPs are owned by founders in their 50s–60s, and buyers know consolidation opportunities are plentiful.

Engineering teams take years to build

Acquiring talent is often faster and cheaper than hiring.

If your firm is profitable with recurring revenue, your company is likely more valuable than you think.

What Drives Your Valuation

Different from software, but still highly investor-friendly. The key drivers:

1. Recurring Revenue (MRR/ARR)

- % of revenue under managed services contracts

- Contract length

- Churn & renewal history

2. EBITDA & Gross Margins

- Utilization rates

- Technician salaries

- Service mix (MSP vs project vs cybersecurity)

3. Client Concentration

- Buyers prefer no customer >20% of revenue, but exceptions exist with the right contracts in place.

4. Technical Capabilities

- Azure/AWS partnership

- Cybersecurity certifications

- Vertical specialization (healthcare, legal, finance)

5. Owner Dependence

- How well the business runs without you daily.

Typical Multiples for MSPs and IT Services (2024–2026)

Multiples vary substantially with recurring revenue mix and EBITDA margin:

| Company Profile | Typical Valuation |

|---|---|

| <20% recurring, heavy project work | 4–6× EBITDA |

| 30–50% recurring, stable client base | 5–8× EBITDA |

| 50%+ recurring, strong security or cloud focus | 6–9× EBITDA |

| Vertical-specialized MSP with cybersecurity | 7–10× EBITDA |

Your actual valuation depends on the specific details of your revenue mix, margins, client profile, and growth path.

My Process Produces Multiple Offers

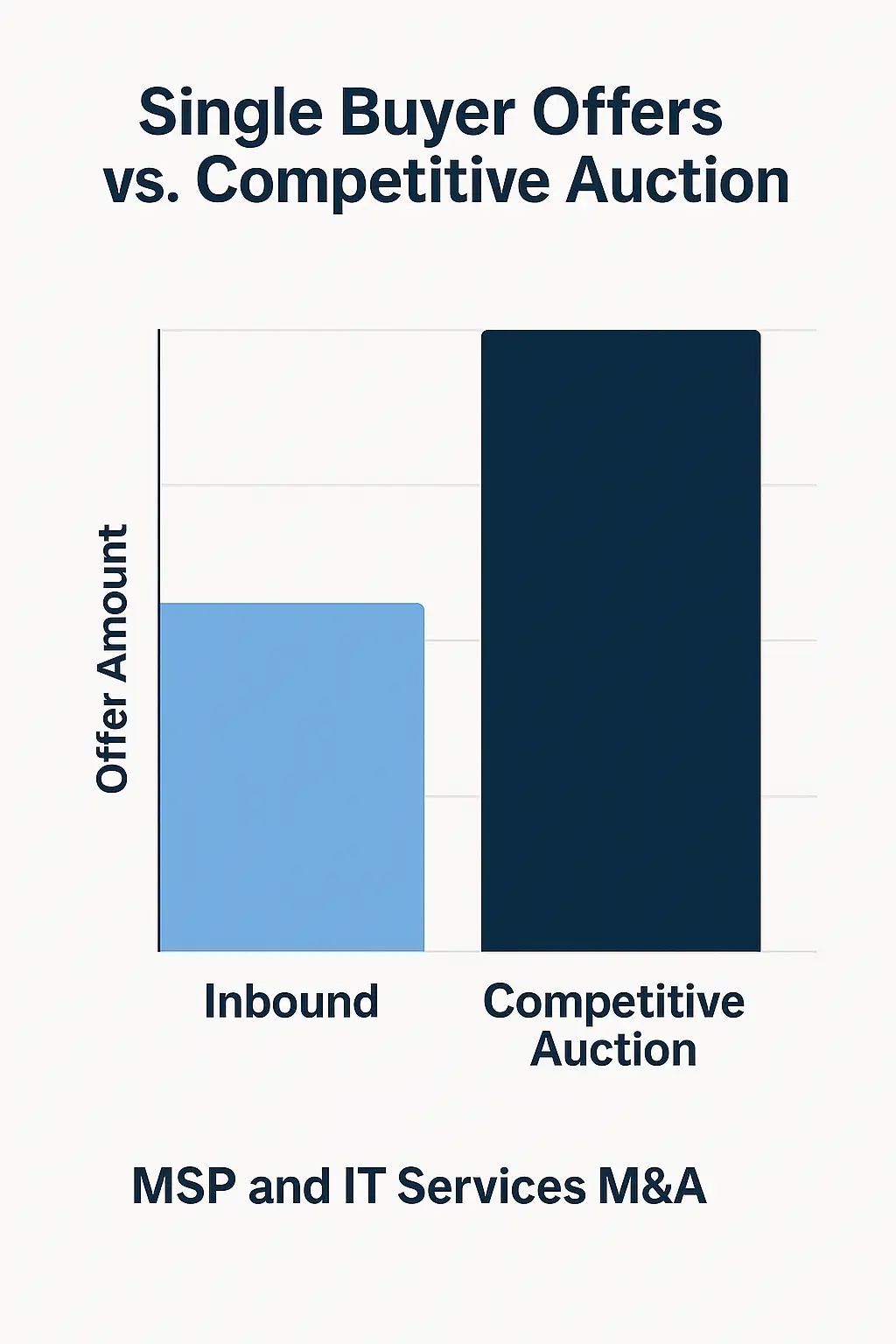

Many MSP owners speak to 1–2 inbound buyers and assume those are market offers. They rarely are.

My process typically includes:

- Initial call

- Confidentiality and data review

- Financial normalization & valuation guidance

- Professional marketing package

- Targeted outreach to 300–1,000+ qualified buyers

- NDA qualification

- Structured meetings between buyers and sellers

- Multiple written offers (10–30 for high-quality firms)

- Negotiation & selection of the best offer

- Due diligence & closing

This is a straightforward, competitive, no-nonsense process, which produces closed deals.

What MSP Owners Care About (and I Prioritize)

Confidentiality

Your clients, employees, and competitors will not hear about the sale. Every buyer is screened, introduced in stages, and held to strict NDAs.

Clean Terms

I prioritize:

- Majority cash at close

- Limited seller notes

- Limited earnouts

- Standard rep & warranty caps

- Minimal post-close surprises

Replacing Non-Serious Buyers

If a buyer delays, retrades, or tries to change terms late in the process, I replace them immediately to maintain momentum.

Respect for Your Time

No constant calls.

Structured, scheduled updates.

Direct communication.

Clear process.

Why Work with Me

Software-Native

I’ve sold software companies, technical service firms, and understand the operational details of recurring revenue, SLAs, ticketing systems, utilization, churn, engineering cost structures, and client concentration risk.

High Success Rate

I have a 100% close rate on representing profitable companies.

Industry-Focused Buyer Network

Hundreds of private equity funds, family offices, and corporate buyers actively looking for MSPs and IT services companies.

No Retainer

I only work with companies I believe I can sell successfully.

Is now the Right Time to Sell?

You may be considering a sale if:

You’re burned out or tired of firefighting

You lack time to grow sales or add new offerings

Hiring engineers has become too time-consuming

You’re nearing retirement

You want to take chips off the table

You want to sell now while valuations remain strong

If any of these describe your situation, it may be worth a confidential conversation.

Next Step: Confidential Intro Call

If you own a profitable MSP, cybersecurity practice, or IT services company and are considering selling in the next 12–24 months, let’s talk.

Schedule a confidential call

I’ll give you:

- Honest feedback

- A realistic valuation range

- Clear steps to prepare

- No pressure and no obligation

You only sell your business once.

The right process delivers a better buyer, better terms, and a better outcome.