Preparing Your SaaS Business For Sale

SaaS Mergers & Acquisitions Services » Prepare Your SaaS Business for Sale

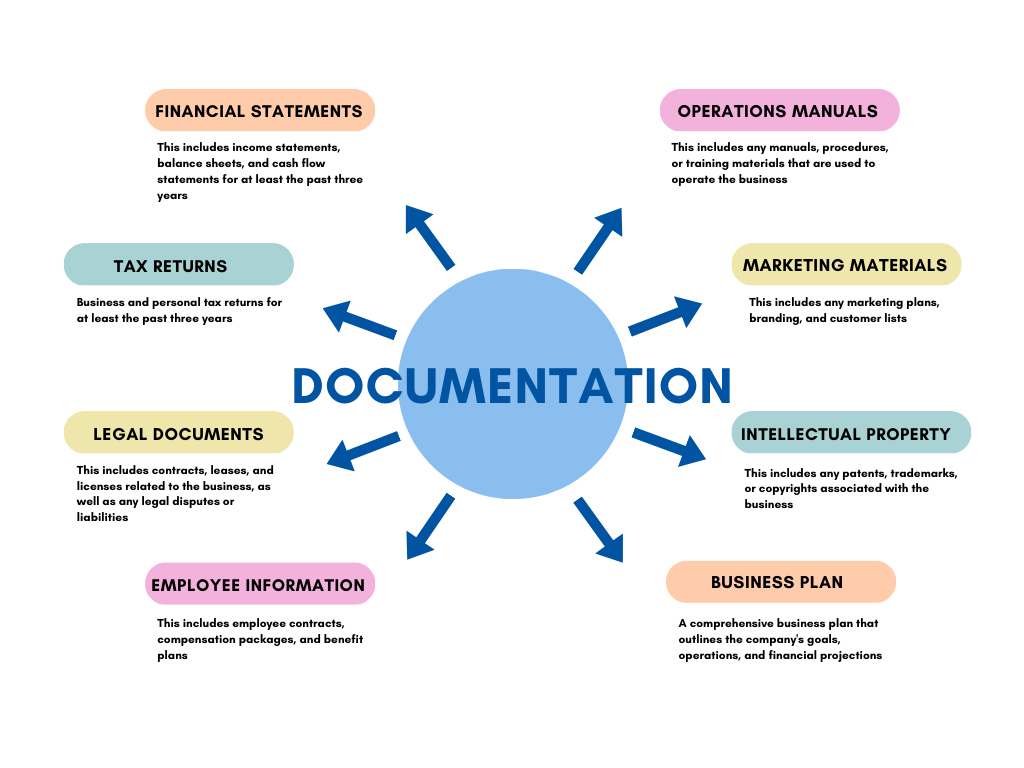

High-quality documentation is crucial to attracting high-value offers.

Preparing your SaaS business for sale is just as critical to getting high offers as preparing a house for sale in a real estate transaction. For a business to be the most attractive to the greatest number of potential buyers, a few aspects of the business need to be in order and properly documented. Remember, your goal is to sell the company, and minimizing the perceived risks is a key way of receiving an attractive, above-market offer.

I pride myself on being able to quickly understand your business from both a financial results perspective and also from a go-to-market perspective. I will work with you to get your business prepared for the market. We will also work together to properly tell the unique story of your business and why it is an attractive acquisition target. My ability to understand your business and communicate it clearly to qualified buyers results in high offer prices with large cash components

My close rate and consistent ability to generate multiple high-value offers speak to my ability to accomplish this critical aspect of selling a company.

All of the key aspects of the business need to be written down and presented in an orderly manner. Proper documentation is so critical, it is often identified as the 2nd most common reason a business fails to sell.

For financial documentation, it is critical to have accurate financial statements. Plan to create and share annual Income Statements, Balance Sheets and Cash Flow Statements(if on an accrual basis) going back at least 3 years. Tax returns for the same periods will also be necessary.

For your revenue generation, most buyers will want to see written contracts for your largest customers. Of course, annual revenue and expenses by customers are also useful in documenting the relationships that are likely to transfer to the new owners. If you have a click-through agreement, then you’ll need to share the different versions of that document. If some customers have customized terms and agreements, you’ll need to share those documents as well in the due diligence process.

For your employees, a potential buyer will want to understand your employee manual and company policies. They’ll want to understand any employment agreements that are in place, especially with key employees.

Documenting relationships with key suppliers, including your landlord will help the new owner to understand these often critical relationships.

This information needs to be prepared and organized before bringing a business to market. Once you find an interested buyer, things will move quickly and you won’t want to lose the opportunity due to lack of preparation.