Structure Your SaaS Business Sale

SaaS Mergers & Acquisitions Services » Structure Your SaaS Business Sale

All cash at the close isn’t common. Knowing how to negotiate the terms of sale based on what’s typical makes a big difference in the final offer.

As a seller, you should expect to receive multiple offers each with a different business sale structure. Knowing how to evaluate the different structures and understanding the pluses and minuses of each is key to making a decision that you’ll be comfortable with many years into the future.

Since most offers won’t be ‘all cash at close’, I work with my clients to negotiate and select the best possible offer from the multiple buyers likely to express confirmed interest in the business.

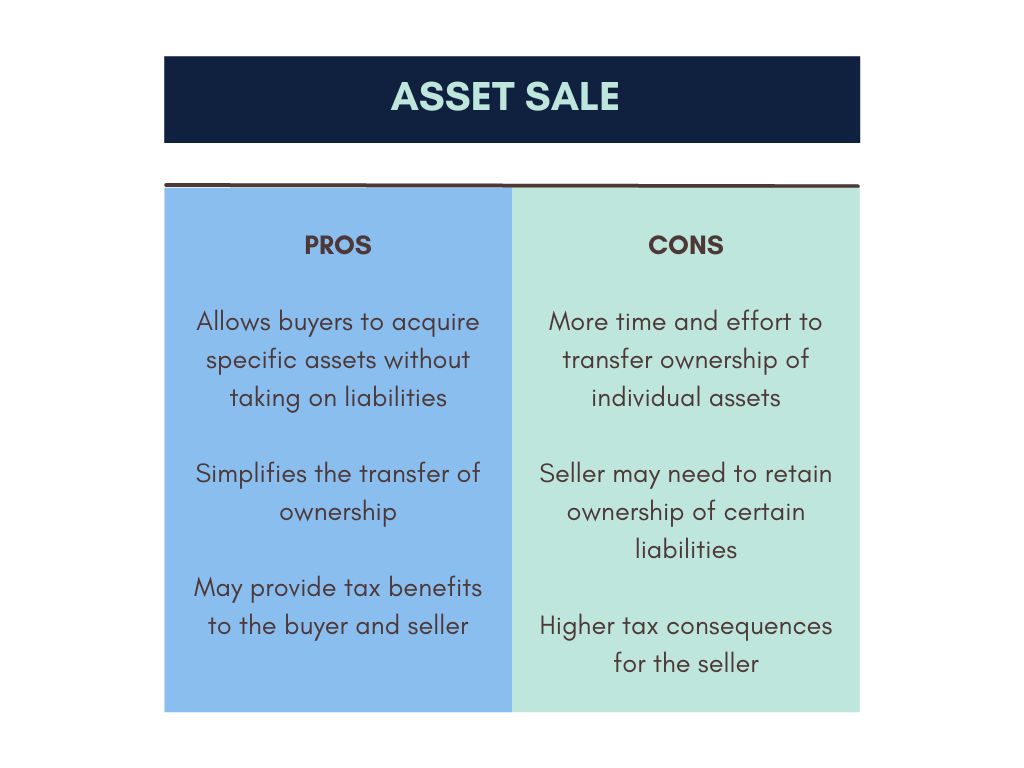

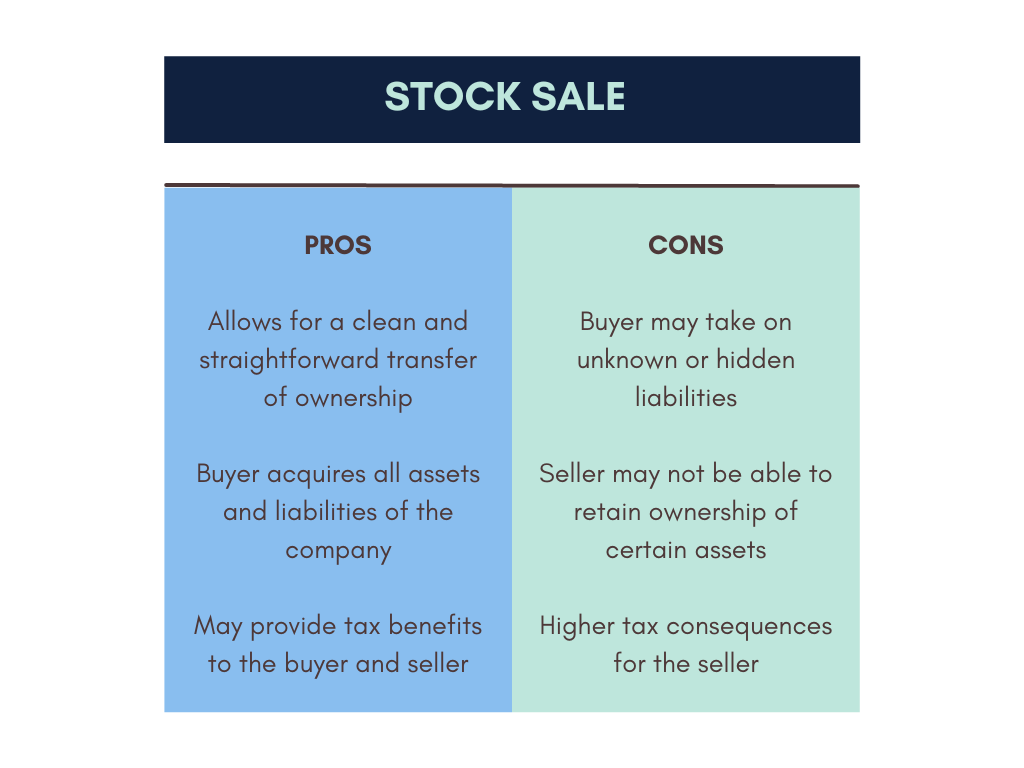

While most offers will be for an asset purchase of the business, depending on the size of your company and the types of agreements you have in place, a stock sale may also be proposed. Both have different obligations when it comes to liabilities and tax consequences.

You may also have personal use of company-owned assets like a vehicle, computer, or cell phone. Clarifying what will happen to these company-owned assets post-close reduces the chances of any misunderstanding in the future.

We will also need to evaluate and negotiate key aspects of due diligence. Knowing what is expected, what is typical and the likely time commitment to supplying the requested information are all concerns for sellers who already have a full-time role running the company daily.

In addition, if you don’t plan to retire after the sale, then it will be important to discuss non-compete agreements to make sure you’re able to keep working after the transaction closes.

It isn’t uncommon to have offers consisting of cash at close, a seller note, a contingent payment (earnout) some amount held in escrow, and potentially shares in the new entity being formed by the buyer. You may also be balancing a tradeoff between an employment agreement and a potential increase in the purchase price.

Adjustments post due diligence for such items as cash, inventory, accounts receivable, prepaid expenses, and taxes are typical as well. Knowing the customary adjustments and how they get calculated in advance will reduce any “unexpected negotiations” post due diligence.

By working with your attorney, CPA, and financial planner in a team approach, we will help you evaluate the possibilities and pick the best option for both your current and future financial and lifestyle needs.

Experience and being able to work effectively with your attorney, CPA, and other advisors allows me to get the best deal structures for my clients.

Final Step »

Close Your SaaS Business Sale

Close Your SaaS Business Sale I work with my clients throughout the entire process of selling a company. From the initial signing of the Representation Agreement …