SaaS Business Valuation

SaaS Mergers & Acquisitions Services » SaaS Business Valuation

Business Valuations for Selling a Company

I provide SaaS business valuations for my clients when it is time to sell their companies. A business valuation estimates the final closing price a financial buyer should be willing to pay for the company; this figure is called the enterprise value. The most common method of calculating enterprise value for small companies is applying a multiple to similar past transactions. (comps / multiples).

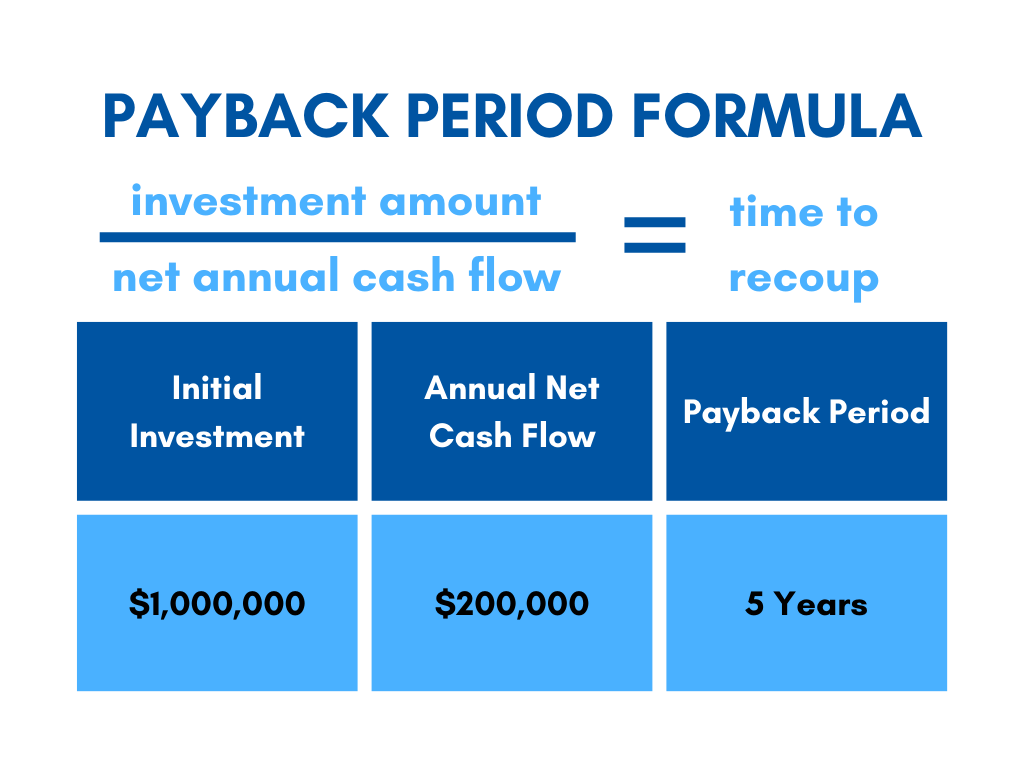

With high-growth companies, it is common to also look at the aggregate value of the future cash flows. You assume the business will continue to grow and earn cash flow on its current trajectory. Based on this assumption, you examine how much cash the company can generate in 3-5 years. This method is sometimes called the payback period method.

SaaS Business Valuations are Estimates

The final transaction price can only be known after the buyer and seller conclude their negotiations.

We only know what the business is worth to a specific buyer through a ‘controlled auction’ and the final deal terms.

Going through the various methods of determining value does help us to estimate what the closing price will be and if the proceeds from the sale of the business will satisfy the financial needs of the business owners.

Negotiations To Determine Deal Terms

The specific allocations of cash, seller notes, carried equity, and earnouts are known after a transaction is negotiated and structured between the parties.

Business Valuations and Exit Planning

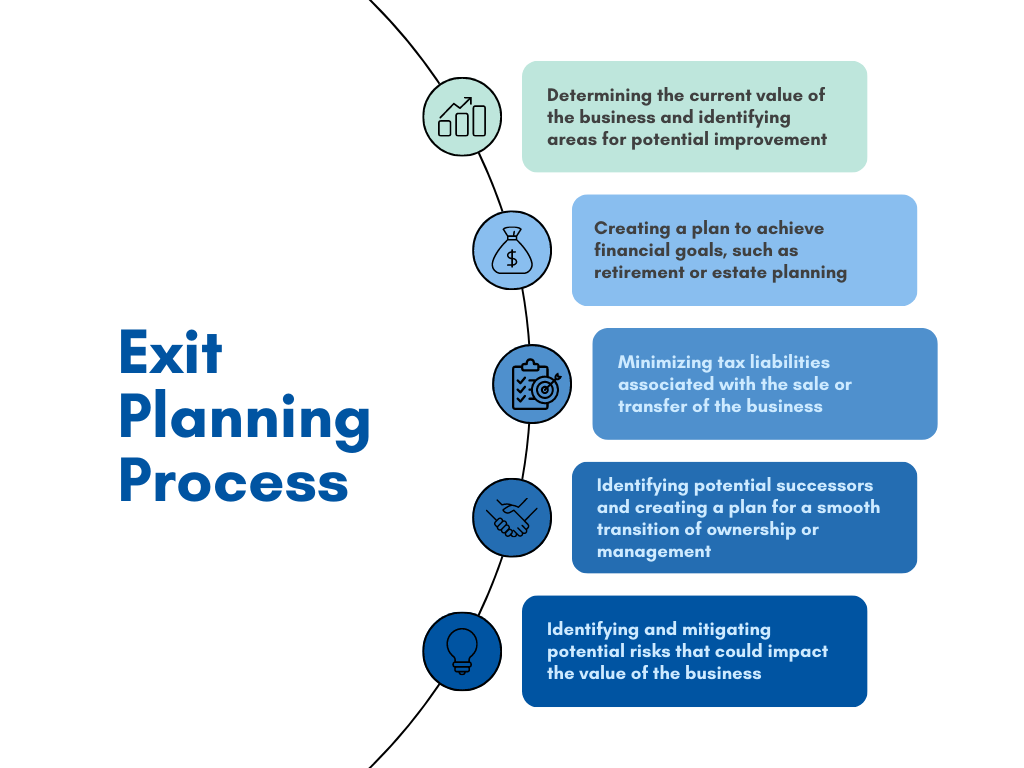

A vital benefit of the business valuation process is that it provides insight into how to increase the value of a business as the owners think about their exit.

The calculations identify the company’s key aspects that make it attractive to potential buyers, all help business owners knowably work towards a successful exit and maximize the value received. The planning and strategy outputs of a business valuation are the main benefit behind the practice of exit planning.

Next Step »

Prepare Your SaaS Business for Sale

Preparing Your SaaS Business For Sale High-quality documentation is crucial to attracting high-value offers. Preparing your SaaS business for sale is just as critical to …