Find a Buyer For Your SaaS Business

As part of the sell-side process, I help find a buyer for your SaaS business from a pool of qualified buyers.

SaaS Mergers & Acquisitions Services » Find a Buyer For Your SaaS Business

My Database of Business Buyers

I maintain a database of active business buyers within my targeted software and B2B services segments. My active acquirers include:

- Corporations

- Private Equity Funds

- Family Offices

- Searchfunds

These buyers are active acquirers of lower middle-market software and services companies. They are looking for business opportunities with $3m-$20m in revenue and 20-50 employees. I’ve learned which characteristics fit their investment criteria by speaking with each buyer.

Many of these buyers do not participate in online marketplaces. Instead, they seek business opportunities from trusted business brokers and intermediaries. This relationship-centric approach helps these buyers to focus on higher quality business opportunities and save considerable time from pursuing opportunities where the sellers are not adequately prepared or have unrealistic expectations.

Where Do I Find Business Buyers?

I find buyers for my clients from two primary sources.

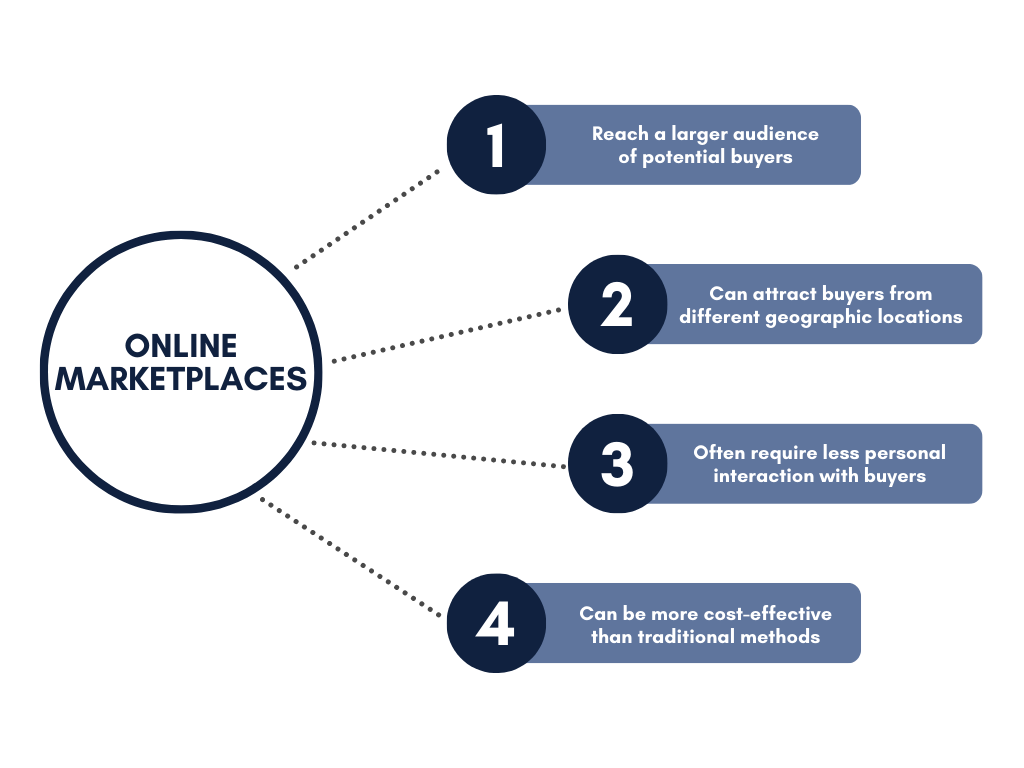

Source 1 – Online Marketplaces – I will list an anonymous advertisement on many online marketplaces. While these advertisements attract many low-quality inquiries, they also attract previously unknown buyers who can be an ideal match for a specific opportunity. Quickly vetting the serious buyers from the unfunded looky-loos is a crucial skill.

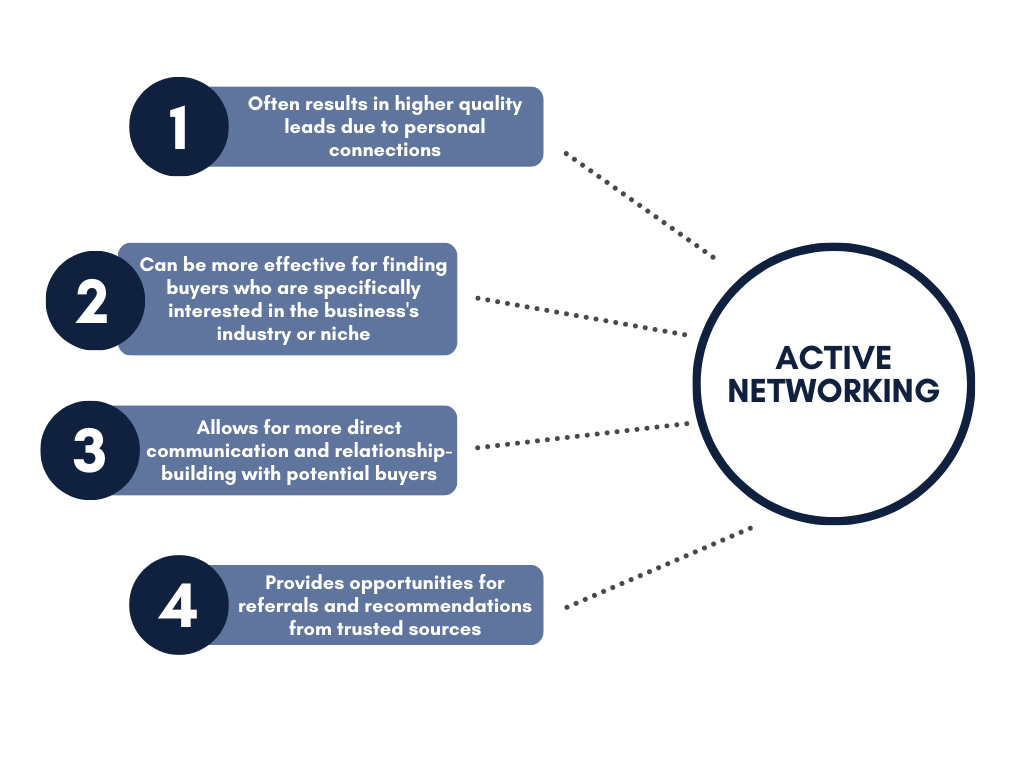

Source 2 – Active Networking – Since I am focused on just software and service company clients in the lower middle market, I devote considerable time networking to find qualified buyers for my current and future listings. Over time, I’ve developed an extensive database of buyers actively looking for the types of clients I represent. With each new opportunity brought to market, this list of potential buyers grows.

SaaS Buyer Preferences

Buyers develop preferences for all different business situations. Some like companies with rapid revenue growth; others prefer stable or declining revenue situations. Some buyers are more comfortable with high customer revenue concentrations; others prefer a more diversified customer base. Having many qualified buyers in my database can match the right group of buyers to each specific sell-side opportunity.

Matching Buyers to Business Opportunities

I also work with my sell-side clients to understand their plans. This information allows me to match them with the proper type of business buyer. Since each deal is unique, understanding the desires of both parties makes finding the right match possible.

In Summary

Having many known, active, and qualified buyers dramatically reduces the time needed to receive offers and close a transaction.

- Sellers don’t meet inappropriate and unqualified buyers.

- Buyers don’t spend time on poor-fitting opportunities and unprepared sellers.

My hands-on, high-touch approach produces exceptional results. I typically receive hundreds of inquiries on my strong listings and can generate ten or more offers.

Next Step »

Maintain Your Business Sale Confidentiality

Maintain Your Business Confidentiality Going to market through a reputable intermediary protects the business confidentiality of your exit plans from customers, suppliers, employees and most importantly competitors. …