SaaS Mergers & Acquisitions

Expert SaaS M&A Advisory for Software, SaaS, and Service-Based Companies: The sell-side process.

How We Can Help

A leading advisor for Lower Middle Market software, SaaS, and service-based companies. David brings tailored expertise to unlock the full potential of your business and maximize value in the sell-side journey. Read on to learn the full SaaS mergers & acquisitions process.

What is the Lower Middle Market?

The Lower Middle Market encompasses a vibrant sector of companies generating annual revenues ranging from $3m to $20m. These businesses represent a vital segment of the economy, driving innovation and growth. However, the financial aspects of selling a Lower Middle Market company faces one significant challenge —the limitations of SBA financing.

Limitations of SBA Financing

SBA financing is a popular option for Main Street businesses seeking to acquire or sell a company. However, Lower Middle Market companies often outgrow the size and complexity constraints that fit within the scope of SBA lending. These businesses, which exhibit significant growth potential and attract strategic buyers, require more substantial financial structures beyond what SBA financing can accommodate.

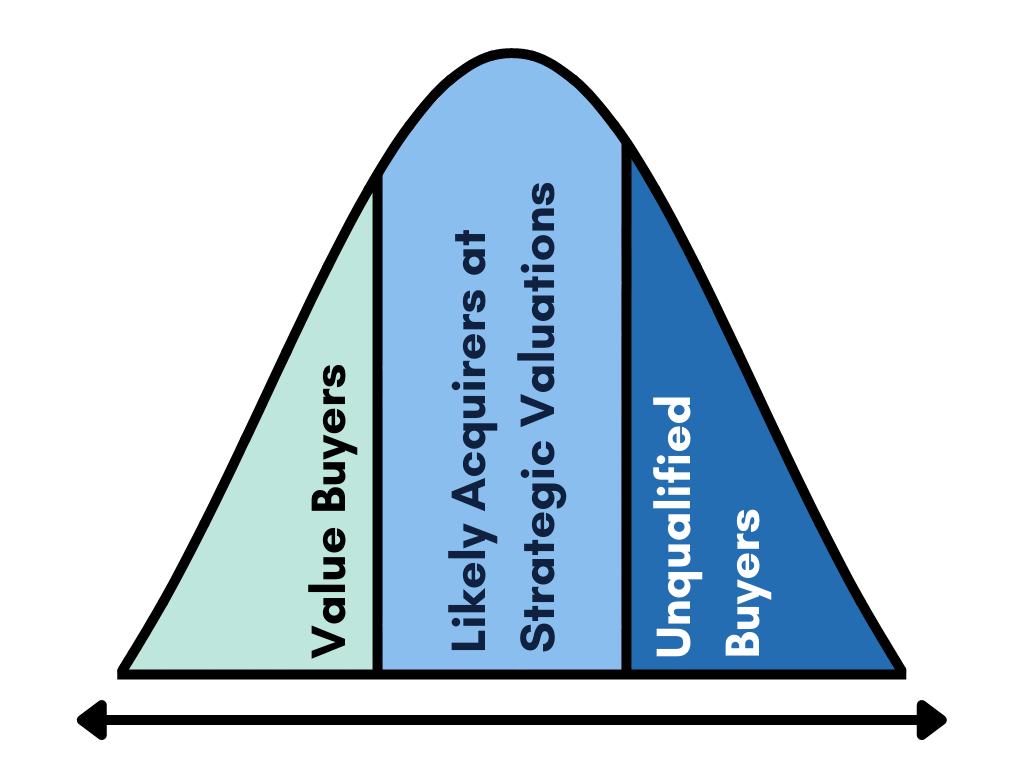

Expand the Potential Buyer Pool

It becomes evident that a specialized approach is necessary to attract a wider pool of potential buyers. As an experienced M&A advisor focused on the Lower Middle Market, he brings deep knowledge and a vast network of contacts, including private equity firms, strategic acquirers, and high-net-worth individuals capable of structuring and executing complex transactions

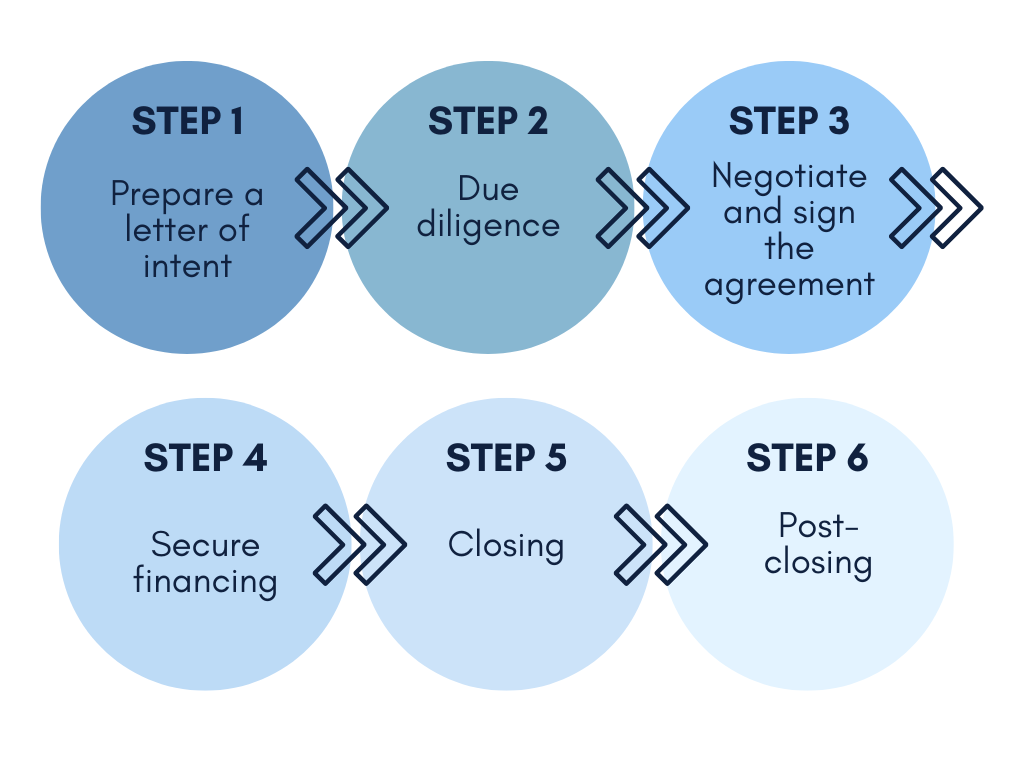

The Sell-Side Process

SaaS Business Valuation

We understand the importance of attracting high-quality buyers for your software and services company. Our valuation process focuses on maximizing your business’s value and appealing to serious and reputable buyers. We provide a clear and realistic picture of your company’s potential by conducting thorough assessments and utilizing multiple valuation models.

This approach helps us attract buyers who recognize the actual value of your business and are committed to completing successful transactions. We prioritize quality over quantity, ensuring that the offers you receive come from buyers who are not only genuine and capable of completing the transaction but also align with your goals and aspirations.

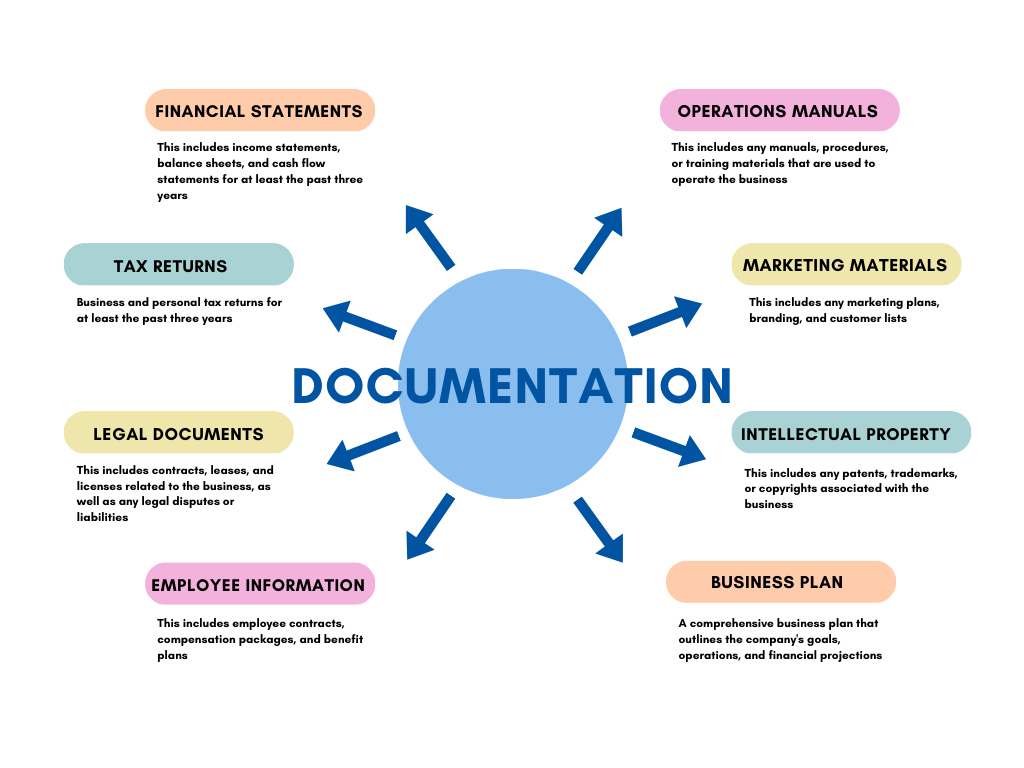

Pre-Sale Preparation

We design our pre-sales process to gather comprehensive and pertinent information that potential buyers require. Our rigorous quality control processes ensure that the information included in the CIM is thorough and accurate, creating a foundation of trust and transparency. While the CIM contains essential details, we also recognize the importance of protecting sensitive information until after an offer is approved and due diligence commences.

This strategic approach ensures that critical details are shared at the appropriate stage, fostering a mutually beneficial environment for sellers and buyers during the SaaS M&A process. Buyers see what they need to make a suitable offer. Sellers don’t share their private information with every unqualified and anonymous inquirer.

Locating Potential Buyers

As a top SaaS M&A business broker, David Jacobs streamlines the process of receiving offers and finalizing transactions for sellers. By leveraging a comprehensive database of known, active, and qualified buyers, he significantly reduces the time required to secure multiple offers. David Jacobs specializes in connecting sellers with buyers specifically interested in software and services companies. His extensive network includes:

- Corporations

- Private Equity Funds

- Family Offices

- Search Funds

- High Net Worth Individuals

David typically attracts hundreds of inquiries for his listings and can generate ten or more offers.

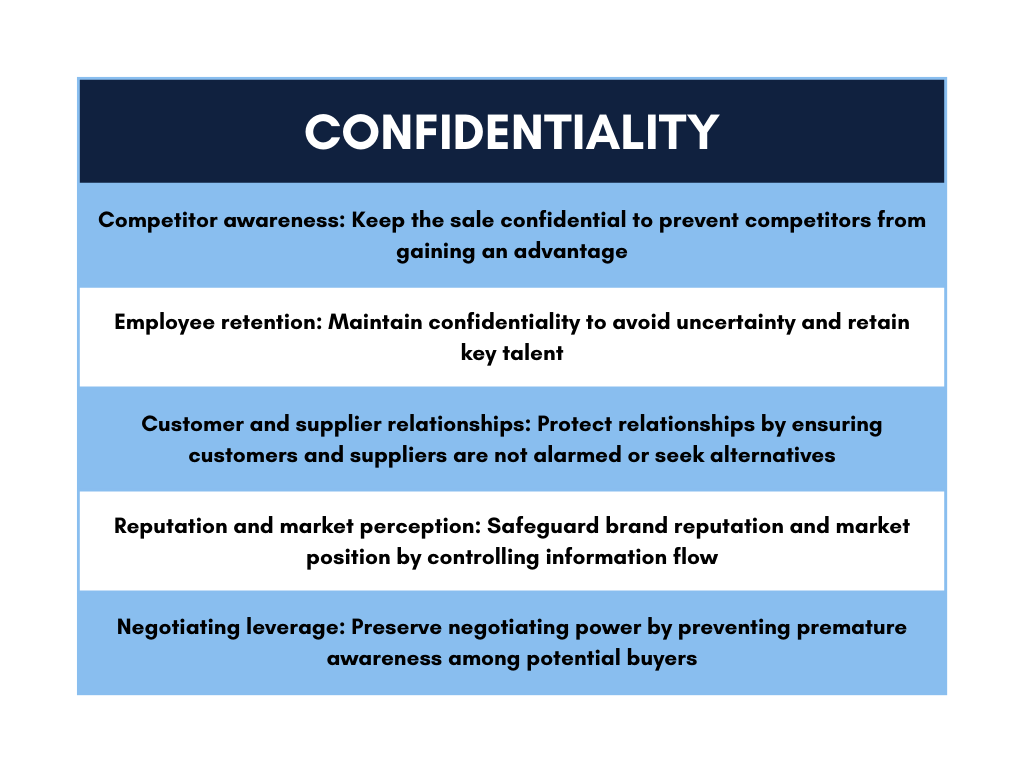

Ensure Business Confidentiality

We understand the paramount importance of confidentiality for sellers in the business sale process. We are committed to protecting the confidentiality of our clients at every step. By safeguarding sensitive information and implementing stringent measures like NDAs, sellers can maintain complete confidentiality throughout the transaction. These shield sellers from inappropriate and unqualified buyers, providing them peace of mind and control over the process.

Our approach saves sellers valuable time by preventing engagement with poor-fitting opportunities and unprepared buyers. Trust us to handle your business sale with the utmost confidentiality, empowering you to achieve optimal outcomes while keeping the privacy and integrity of your business.

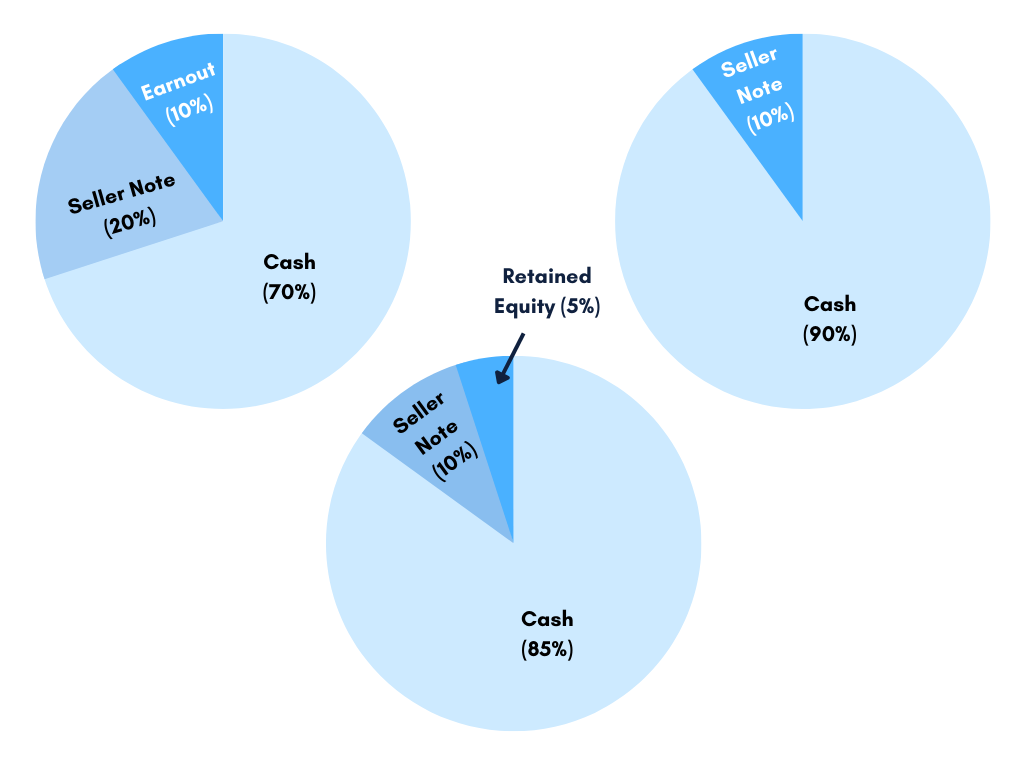

Structuring the Sale

When it comes to selling a business, the complex procedures involved require the expertise of an experienced advisor. David advises his clients on the intricacies of structuring the sale to ensure the best outcome. With extensive knowledge and insight, David provides valuable advice on structuring the deal for optimal results. During the process, various elements come into play, such as cash offers, seller notes, contingent payments (earnout), escrow amounts, or potential shares in the buyer’s new entity.

David expertly advises on the best approach, including considerations like employment agreements and tax efficiency. David collaborates closely with the client’s attorney, CPA, and financial planner, adopting a tailored and holistic approach. This enables him to evaluate and negotiate business sale terms, ensuring tax efficiency and selecting the option that best aligns with the client’s current and future financial and lifestyle needs.

Closing and Post-Sale

David Jacobs specializes in creating a smooth sales process, from the initial engagement to completed due diligence, signed purchase agreements, and funds transfer. His commitment extends beyond the sale itself. He provides comprehensive support during the closing and post-sale phases to ensure our clients’ smooth transition.

With meticulous attention to detail, he navigates the final stages of the transaction, coordinating with legal and financial professionals to facilitate a seamless closing. Once the sale is complete, he assists clients in the post-sale phase. Count on him to be your trusted partner throughout the closing and post-sale journey, dedicated to your long-term success.